All Categories

Featured

Table of Contents

At the end of the day you are buying an insurance policy product. We like the security that insurance policy uses, which can be acquired much less expensively from an affordable term life insurance plan. Overdue finances from the plan might likewise lower your fatality advantage, reducing an additional degree of protection in the policy.

The idea only works when you not only pay the substantial costs, however use extra cash money to buy paid-up enhancements. The possibility expense of every one of those bucks is incredible very so when you might instead be investing in a Roth IRA, HSA, or 401(k). Also when contrasted to a taxed financial investment account or perhaps a financial savings account, infinite financial may not use comparable returns (contrasted to spending) and similar liquidity, accessibility, and low/no charge framework (contrasted to a high-yield interest-bearing accounts).

When it comes to economic preparation, entire life insurance policy frequently sticks out as a popular choice. There's been a growing trend of advertising it as a tool for "limitless financial." If you have actually been exploring entire life insurance policy or have stumbled upon this principle, you may have been told that it can be a method to "become your very own bank." While the concept might sound attractive, it's essential to dig deeper to comprehend what this truly indicates and why seeing whole life insurance policy in this method can be misleading.

The concept of "being your own financial institution" is appealing since it recommends a high degree of control over your funds. This control can be imaginary. Insurance firms have the supreme say in just how your plan is managed, consisting of the terms of the lendings and the prices of return on your money worth.

If you're considering whole life insurance policy, it's necessary to view it in a more comprehensive context. Entire life insurance policy can be a beneficial device for estate preparation, offering an ensured survivor benefit to your recipients and possibly offering tax benefits. It can additionally be a forced cost savings automobile for those that have a hard time to save cash constantly.

It's a form of insurance policy with a savings component. While it can provide stable, low-risk growth of cash money worth, the returns are generally less than what you could achieve through other financial investment lorries (permanent life insurance infinite banking). Prior to leaping right into entire life insurance with the concept of boundless banking in mind, make the effort to consider your economic goals, threat resistance, and the full variety of economic items readily available to you

Non Direct Recognition Whole Life Insurance

Unlimited financial is not an economic remedy. While it can operate in specific circumstances, it's not without dangers, and it calls for a significant dedication and understanding to take care of properly. By recognizing the prospective mistakes and recognizing real nature of whole life insurance, you'll be better geared up to make an educated choice that sustains your economic well-being.

This publication will educate you just how to set up a financial policy and exactly how to use the banking policy to purchase property.

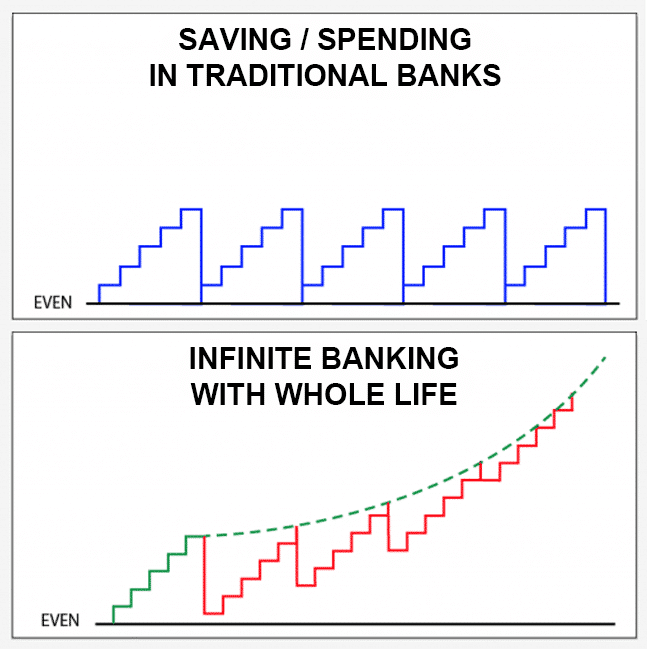

Limitless banking is not a service or product offered by a specific establishment. Infinite banking is a strategy in which you purchase a life insurance policy plan that gathers interest-earning cash money value and get financings against it, "obtaining from on your own" as a source of funding. After that at some point repay the lending and start the cycle throughout again.

Pay policy premiums, a part of which builds money worth. Take a funding out versus the plan's cash money worth, tax-free. If you use this principle as planned, you're taking cash out of your life insurance plan to buy everything you would certainly require for the remainder of your life.

The are whole life insurance and universal life insurance coverage. The cash value is not added to the fatality benefit.

The policy funding passion price is 6%. Going this route, the rate of interest he pays goes back into his policy's cash worth instead of an economic organization.

Cipher Bioshock Infinite Bank

Nash was a financing professional and fan of the Austrian school of economics, which supports that the value of items aren't explicitly the outcome of conventional economic structures like supply and need. Instead, people value cash and items in a different way based on their financial condition and requirements.

Among the challenges of typical financial, according to Nash, was high-interest prices on lendings. Also several people, himself included, got involved in monetary difficulty as a result of dependence on banking organizations. So long as banks set the rates of interest and loan terms, individuals really did not have control over their own wide range. Becoming your own lender, Nash determined, would certainly put you in control over your financial future.

Infinite Financial requires you to own your economic future. For goal-oriented individuals, it can be the best financial tool ever before. Right here are the benefits of Infinite Financial: Arguably the solitary most valuable facet of Infinite Financial is that it enhances your cash money circulation.

Dividend-paying whole life insurance coverage is really low risk and supplies you, the insurance holder, a terrific offer of control. The control that Infinite Financial provides can best be grouped into 2 groups: tax obligation benefits and property securities.

When you make use of whole life insurance policy for Infinite Financial, you enter right into an exclusive contract in between you and your insurer. This personal privacy offers particular asset protections not located in various other monetary cars. These securities might differ from state to state, they can include defense from asset searches and seizures, protection from reasonings and security from financial institutions.

Entire life insurance coverage plans are non-correlated properties. This is why they function so well as the monetary structure of Infinite Banking. No matter of what takes place in the market (supply, actual estate, or otherwise), your insurance policy maintains its worth.

Start Your Own Personal Bank

Market-based financial investments expand riches much faster yet are revealed to market fluctuations, making them inherently risky. Suppose there were a 3rd pail that provided safety however also modest, surefire returns? Entire life insurance policy is that third pail. Not only is the price of return on your whole life insurance policy ensured, your survivor benefit and premiums are likewise assured.

Here are its main benefits: Liquidity and accessibility: Plan fundings offer prompt access to funds without the constraints of standard financial institution car loans. Tax obligation performance: The cash money worth grows tax-deferred, and policy lendings are tax-free, making it a tax-efficient device for building wealth.

Possession security: In numerous states, the cash worth of life insurance is protected from lenders, including an additional layer of economic safety and security. While Infinite Financial has its values, it isn't a one-size-fits-all option, and it features substantial downsides. Below's why it might not be the most effective approach: Infinite Financial typically requires elaborate policy structuring, which can perplex insurance policy holders.

Visualize never ever having to fret about financial institution lendings or high interest rates again. Suppose you could obtain cash on your terms and develop wide range concurrently? That's the power of unlimited banking life insurance policy. By leveraging the cash money worth of entire life insurance policy IUL policies, you can expand your wide range and borrow money without relying upon conventional financial institutions.

There's no set lending term, and you have the flexibility to choose the repayment timetable, which can be as leisurely as settling the finance at the time of death. This flexibility encompasses the servicing of the lendings, where you can opt for interest-only settlements, maintaining the finance balance level and convenient.

Holding cash in an IUL fixed account being credited rate of interest can commonly be much better than holding the money on down payment at a bank.: You've constantly imagined opening your very own pastry shop. You can borrow from your IUL plan to cover the preliminary expenditures of renting out an area, acquiring devices, and employing staff.

Privatized Banking Policy

Individual lendings can be acquired from conventional banks and lending institution. Below are some bottom lines to consider. Credit history cards can supply an adaptable means to obtain money for really short-term periods. However, obtaining cash on a credit rating card is usually extremely expensive with annual portion rates of passion (APR) usually reaching 20% to 30% or more a year.

The tax obligation therapy of plan car loans can vary dramatically relying on your nation of home and the specific terms of your IUL policy. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy fundings are usually tax-free, supplying a considerable advantage. Nevertheless, in other territories, there might be tax implications to consider, such as prospective taxes on the finance.

Term life insurance policy only offers a survivor benefit, without any cash money worth buildup. This indicates there's no cash value to borrow against. This short article is authored by Carlton Crabbe, Principal Exec Officer of Resources permanently, a specialist in providing indexed universal life insurance accounts. The info offered in this short article is for academic and informative purposes just and must not be interpreted as monetary or financial investment guidance.

Nonetheless, for financing police officers, the considerable regulations imposed by the CFPB can be viewed as troublesome and limiting. Loan police officers typically say that the CFPB's laws develop unnecessary red tape, leading to more documents and slower loan handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) requirements, while focused on safeguarding consumers, can result in hold-ups in closing offers and raised operational prices.

Table of Contents

Latest Posts

Infinite Concepts Scam

Becoming Your Own Banker

Infinite Banking Nelson Nash

More

Latest Posts

Infinite Concepts Scam

Becoming Your Own Banker

Infinite Banking Nelson Nash